Bitcoin Liberation: Yan Pritzker’s Personal Journey to Freedom

Bitcoin is about so much more than merely “number go up.” It’s a tool to reclaim individual economic freedom from those who seek to take that freedom away. And that is something to be optimistic about!

Bitcoin can mean different things to different people. To me, it represents a personal fight for freedom. Having lived in a country where basic freedoms were suppressed, Bitcoin holds a special significance for me.

Pritzker family photo, USSR 1989. Yan is second from the left.

In 1989, my family left Ukraine, which was then a part of the Soviet Union.

There, prices were fixed, capital was controlled, information was censored, people were routinely and arbitrarily jailed, and the government set exchange rates that hid the truth of the ever-devaluing ruble.

The economy was failing to supply basic goods. Many people lived in tiny apartments with three generations of family members. A pair of jeans could cost you a month’s salary.

If you ever saw a line forming at a store, you would stand in it regardless of what was being offered that day because you would purchase anything you could and exchange it on the black market for what you needed.

Although I was lucky to receive a high-quality high school and university education after immigrating to the United States, I was unaware of the role of monetary policy in shaping Soviet society until I started learning about Bitcoin at the age of 35.

I asked my parents about what happened to our money when we left the Soviet Union. What I learned shocked me.

When my family left the Soviet Union, the government only allowed us to exchange $100 per person at their fixed ruble exchange rate.

The street value of these rubles was almost nothing, so we took what little we could, along with suitcases of trinkets, to sell on our way to America.

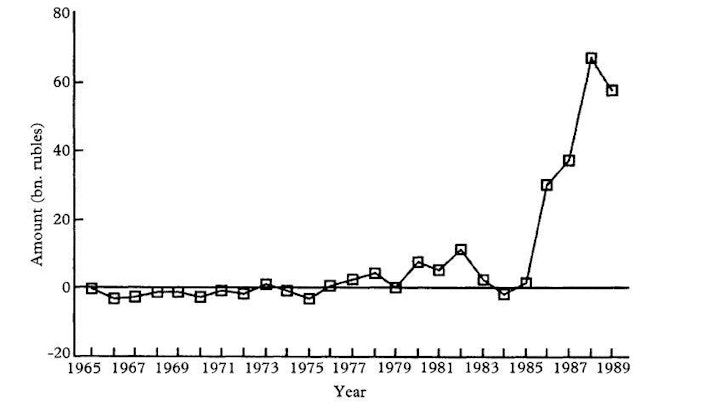

Byung-Yeon Kim, “Causes of Repressed Inflation in the Soviet Consumer Market, 1965–1989: Retail Price Subsidies, the Siphoning Effect, and the Budget Deficit,” Economic History Review 55, no. 1 (February 2002): 121.

This was an example of the ugly face of capital controls: we could leave the country, but we had to start over. Our money wasn’t really ours!

I discovered this problem wasn’t unique to the Soviet Union. It continues to happen all over the world today. By controlling the flows of capital, governments can effectively control their population, preventing the free movement of people to better jurisdictions and censoring people by cutting off their ties with financial services.

Bitcoin fixes this!

Bitcoin makes money truly portable and difficult to censor, giving people a real bargaining chip against their leaders for the first time in history. If only my family had access to Bitcoin when fleeing the Soviet Union, we could have left with our wealth intact.

While many native-born Americans may find it difficult to imagine, immigrants are all too familiar with the problems of autocratic governments.

Unlike the United States, other countries do not have the privilege of a reserve currency that is widely in demand. Instead, governments there abuse their money printer, leading to massive currency devaluation. As they run into problems, governments tighten controls on money and information in a desperate attempt to hold their population hostage, with predictably disastrous results.

We cannot take our privileges for granted. We will lose our freedoms if we do not fight to maintain them. Politicians have lied to our faces about the inflation we experience. Economists have combined inflation into a single irrelevant number while manipulating the components that go into its calculation. We have seen the utter incompetence of our central bank, which created stock market bubbles through a zero interest rate policy, followed by blowing up banks when they raised rates.

The United States currently abuses our reserve currency privilege to print ever more currency to finance perpetual war while causing the rest of the world to suffer by exporting our inflation.

Now, we are seeing this behavior start to turn on us, with several countries starting to look for alternatives to U.S. hegemony.

As our currency devalues, our prices distort, and the government pushes for unconstitutional surveillance over all financial transactions, people have naturally flocked to Bitcoin as an escape hatch.

Recent actions led by Sen. Elizabeth Warren demonstrate the government’s attempt to crack down on this escape hatch, and it’s all too reminiscent of the former Soviet Union.

First, the proposals are trying to remove all semblance of privacy from our financial transactions by forcing banks into spying on citizens for any attempt to remain private in our financial transactions.

On top of that, they are even going after our free speech rights by proposing regulating our Bitcoin nodes with legislation that would call every node a money services business.

Do not be misled. These are attempts to prevent you, a “free” citizen, from being free to do what you want with your money. It is an attempt to lock you in, to prevent you from speaking freely, from choosing what to do with your wealth, and ultimately from leaving with your wealth, intact should the need arise.

Bitcoin multiplies the internet’s democratizing effect on information by bringing control of money back to the people and creating permanent, free market incentives to develop energy infrastructure critical to human flourishing.

Imagine if you could get paid instantly for work you perform in money that cannot be seized by your government? What if governments required consent from citizens before waging wars abroad? What if citizens could protect their wealth from runaway inflation?

Well, for the first time ever, in Bitcoin, we have an instrument to protect ourselves from monetary debasement and overreaching governments. And that is something to be optimistic about. Bitcoin is about so much more than merely “number go up.” It’s a tool to reclaim individual economic freedom from those who seek to take that freedom away.

Yan Pritzker is the co-founder and CTO of Swan Bitcoin. Yan spent the last twenty years as a software developer and entrepreneur focusing on tech startups. His most recent company, Reverb, was acquired by Etsy in 2019. Yan is the author of the book Inventing Bitcoin, a quick guide to why Bitcoin was invented and how it works.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Yan Pritzker is the co-founder and CTO of Swan Bitcoin, the best place to buy Bitcoin with easy recurring purchases straight from your bank account. Yan is also the author of Inventing Bitcoin, a quick guide to why Bitcoin was invented and how it works.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.

Why You Should Care About Robinhood Fees Right Now

By Drew

In this post we analyze and explain Robinhood’s hidden fees, how they make money despite not charging any trading fees and why Swan’s fee structure is among the most customer friendly in the industry.